Expanding into Czechia: E-Commerce Opportunities

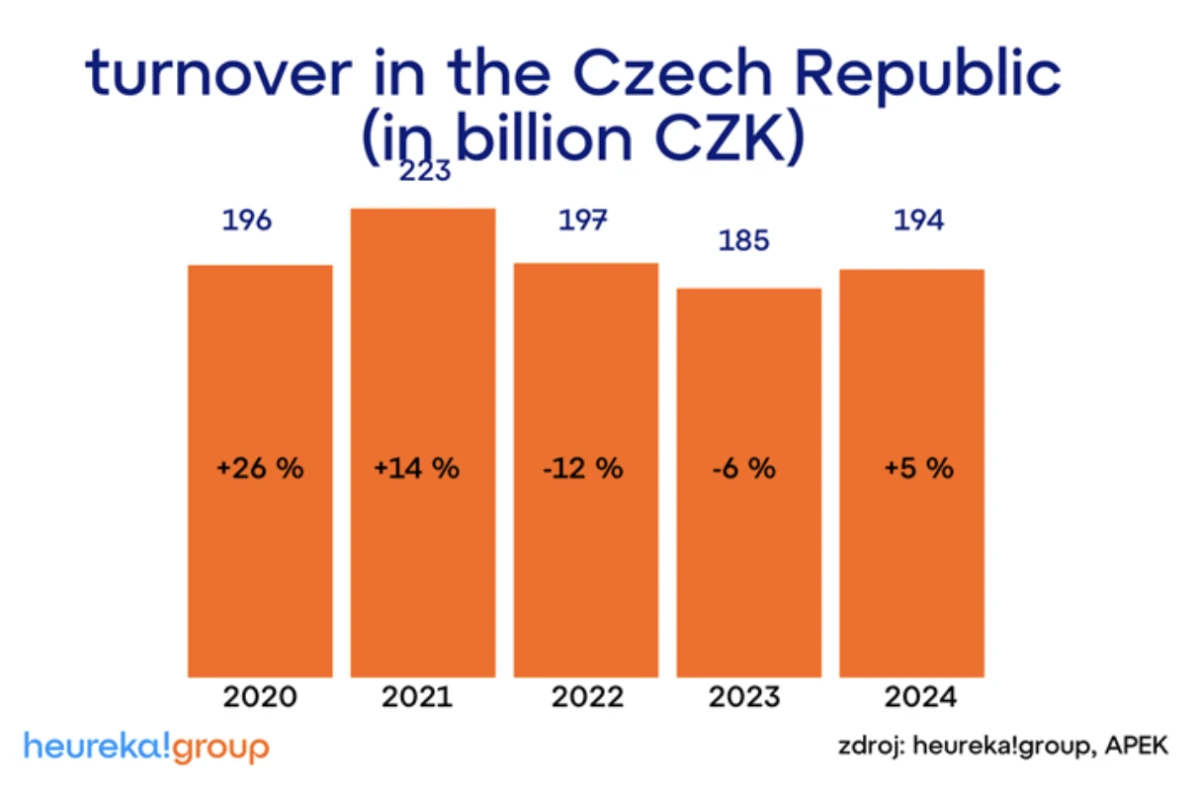

Imagine a market where nine out of ten people are online, where e-commerce continues to grow steadily despite global uncertainties – and where local champions like Alza.cz and Heureka.cz set the tone. Czechia is exactly that kind of market: digitally savvy, affluent, and fast-growing. In 2024 alone, e-commerce revenues reached CZK 194 billion (approx. €7.9 billion) – a 5 % increase compared to the previous year. And in Q2 2025, growth accelerated to +8 %, with June standing out as a particularly strong month. On top of that, around 91 % of the population uses the internet regularly – one of the highest rates across the EU.

Imagine a market where nine out of ten people are online, where e-commerce continues to grow steadily despite global uncertainties – and where local champions like Alza.cz and Heureka.cz set the tone. Czechia is exactly that kind of market: digitally savvy, affluent, and fast-growing. In 2024 alone, e-commerce revenues reached CZK 194 billion (approx. €7.9 billion) – a 5 % increase compared to the previous year. And in Q2 2025, growth accelerated to +8 %, with June standing out as a particularly strong month. On top of that, around 91 % of the population uses the internet regularly – one of the highest rates across the EU.

Curious? This guide will walk you step by step through launching your online shop in Czechia the professional way.

Executive Summary

Czechia as a growth market. The Czech e-commerce sector reached ~€7.9bn in 2024 and continues to grow at around 5 % per year — making it one of the most dynamic markets in Central & Eastern Europe.

High online affinity. 82 % of Czech shoppers browse online stores weekly, and 46 % purchase at least once a week. About 34 % order from abroad regularly — especially from Germany.

Distinct buying behaviour. Strong price sensitivity, high expectations for fast delivery and transparent costs. Popular delivery options include parcel shops and lockers; 68 % would change the delivery address if they’re not home.

Local platforms matter. Beyond Google (~82 % market share), Seznam.cz (~12 %) still matters. Comparison portals like Heureka.cz and marketplaces such as Alza.cz are essential for reach and trust.

“Made in Germany” = trust bonus. German products enjoy a strong reputation for quality and reliability in Czechia — a valuable differentiator for German brands.

Success Factors for Expansion

Localization beyond translation (language, currency, payment methods, customer service).

Transparent delivery terms & fair pricing to prevent cart abandonment.

Social proof via reviews and trust seals as core trust drivers.

Flexibility & iterative improvement after market entry.

Real-world example: About You

About You surpassed 1 million orders in its first year after launching aboutyou.cz — driven by robust localization, large-scale marketing, and relentless customer focus.

Expert tip from practice

International companies should begin with a solid market analysis, align with local shopping habits, and optimize processes iteratively — rather than aiming for a “perfect” setup from day one.

Czechia: Digital, and on the Rise

Czechia is an exceptionally interesting market. In particular, ‘Made in Germany’ enjoys an excellent reputation here. Since the Covid pandemic, Czech e-commerce has been growing steadily – today it is among the fastest-growing online markets in Europe, making it especially exciting.

Czechia ranks among the most dynamic e-commerce markets in Central and Eastern Europe – offering international companies an attractive entry point for expansion.

Already 91 % of the population is online. Czechs have more budget for online shopping, and the convenience of e-shops is increasingly valued. On top of that, the government has made it a priority to further support e-commerce.

What makes the market especially interesting: Unlike in Germany, Amazon does not dominate here. Instead, local players like Alza.cz lead the way – generating annual revenues of over CZK 45 billion (approx. €1.8 billion). Comparison portals such as Heureka.cz also play a central role in purchasing decisions. At the same time, there are unique shopping habits: cash on delivery is still widespread, while modern payment methods like Apple Pay and Google Pay are growing rapidly.

For international businesses, this means: Czechia is digitally savvy and full of growth potential – but it follows its own rules. A successful market entry via an online shop therefore requires more than just language and currency localization. It demands a deep understanding of local consumer habits, marketing channels, and logistics solutionssuch as Zásilkovna, the country’s popular parcel pick-up network.

Czechia as an E-Commerce Hotspot

Every country has its quirks – and Czechia is no exception. Anyone aiming to succeed with an online shop here needs a solid grasp of the typical consumer habits, key platforms, and technical requirements. While high internet penetration and the steady growth of e-commerce are highly promising, success ultimately depends on adapting to local specifics.

Shopping Behavior: Price-Conscious and Demanding

Czech consumers compare extensively before making a purchase decision. A solid price–performance ratio is non-negotiable, just like fast and transparent delivery. Shoppers are willing to pay slightly higher prices – as long as the product arrives reliably and without hidden costs. In contrast, long delivery times or hidden fees quickly lead to abandoned carts. That’s why it’s crucial to list all additional costs, such as shipping fees, upfront.

That quality and service are valued becomes clear in the data: 96.3 % of online shoppers rated their experiences positively in 2024. The average order value in Q4 stood at CZK 1,333 (≈ €54) – slightly lower than the previous year. This suggests that alongside electronics, more everyday, lower-priced products are being purchased online, pulling down the average.

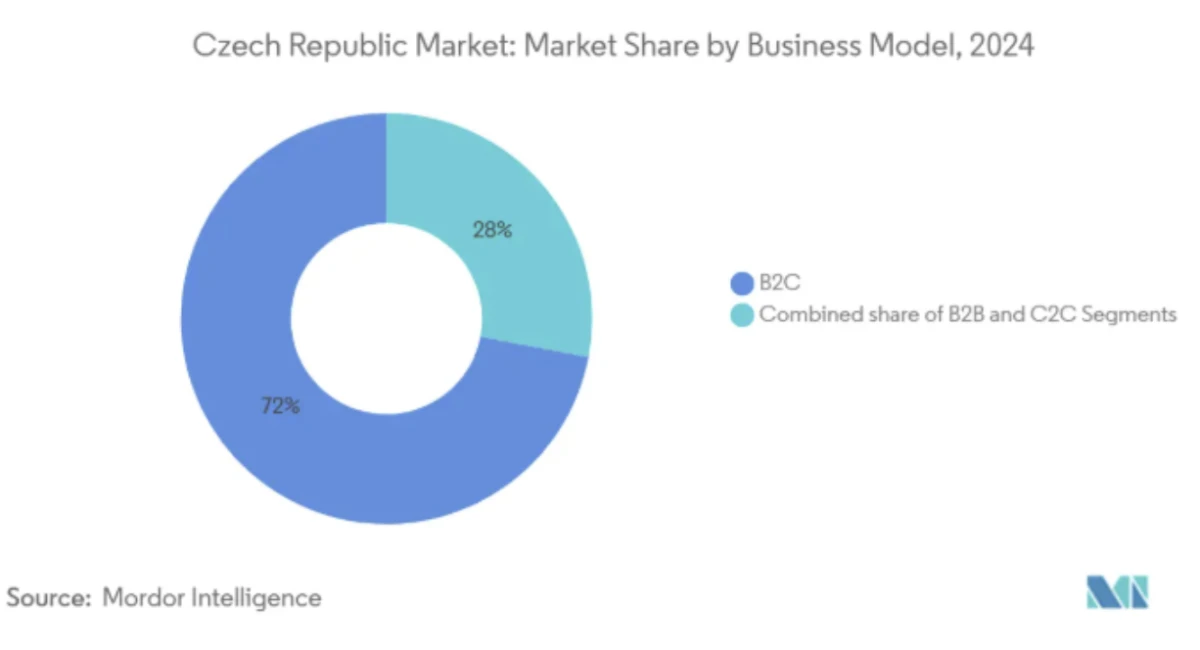

When it comes to payment methods, cash on delivery still dominates, followed closely by bank transfers. However, change is underway: “Buy now, pay later” models are gaining popularity, especially in the fashion and electronics segments. Looking at market structure, B2C clearly leads with around 72 % of online shops, while C2C remains smaller but is expected to grow at a CAGR of 6.5 % through 2030.

Comparison Portals and Marketplaces as Keys to Success

Unlike in Germany, where Amazon dominates, different players shape the Czech market. The price comparison portal Heureka.cz is the go-to platform for consumers – without visibility there, reach drops significantly. Czech shoppers are also more price-sensitive than German customers: 62 % subscribe to newsletters just to catch discounts and promotions. Trust seals from Heureka or the industry association APEK further boost purchase willingness.

At the same time, Alza.cz – with annual revenues exceeding CZK 45 billion (≈ €1.8 billion) – is often referred to as the “Amazon of Czechia.” For international companies, this means that a smart strategy combines their own online shop, marketplace presence, and comparison portals to build reach and trust.

“In Czechia, there are countless online shops, and customer expectations for speed and service are high. Alza.cz, for example, sometimes delivers on the very same day – even on Saturdays. That sets the benchmark for the entire market.What’s remarkable: Alza has grown into a profitable market leader without major external investors, relying only on bank financing. This achievement pushes the competition forward – especially since many of Alza’s rivals have failed to do the same and continue to operate at a loss year after year.”

The Rise of Mobile Commerce

Czech e-commerce is heavily mobile-driven. Already 63 % of all purchases are made via smartphones, and with 5G coverage reaching 94.6 % of households, this trend is only accelerating. Forecasts predict an annual growth rate (CAGR) of 7.1 % through 2030.

For retailers, this makes a mobile-optimized shop non-negotiable: fast loading times, intuitive navigation, and seamless integration of popular mobile payment options such as Apple Pay and Google Pay are now the standard.

Trends and Growth Segments

Demand in Czech e-commerce is shifting toward exciting niches. According to Heureka, in 2024 the strongest growth was recorded in cycling shorts (+694 %), solar kits (+604 %), and kindergarten furniture (+562 %), while traditional categories such as soda-maker accessories (–86 %) or wedding dresses (–79 %) lost significant relevance.

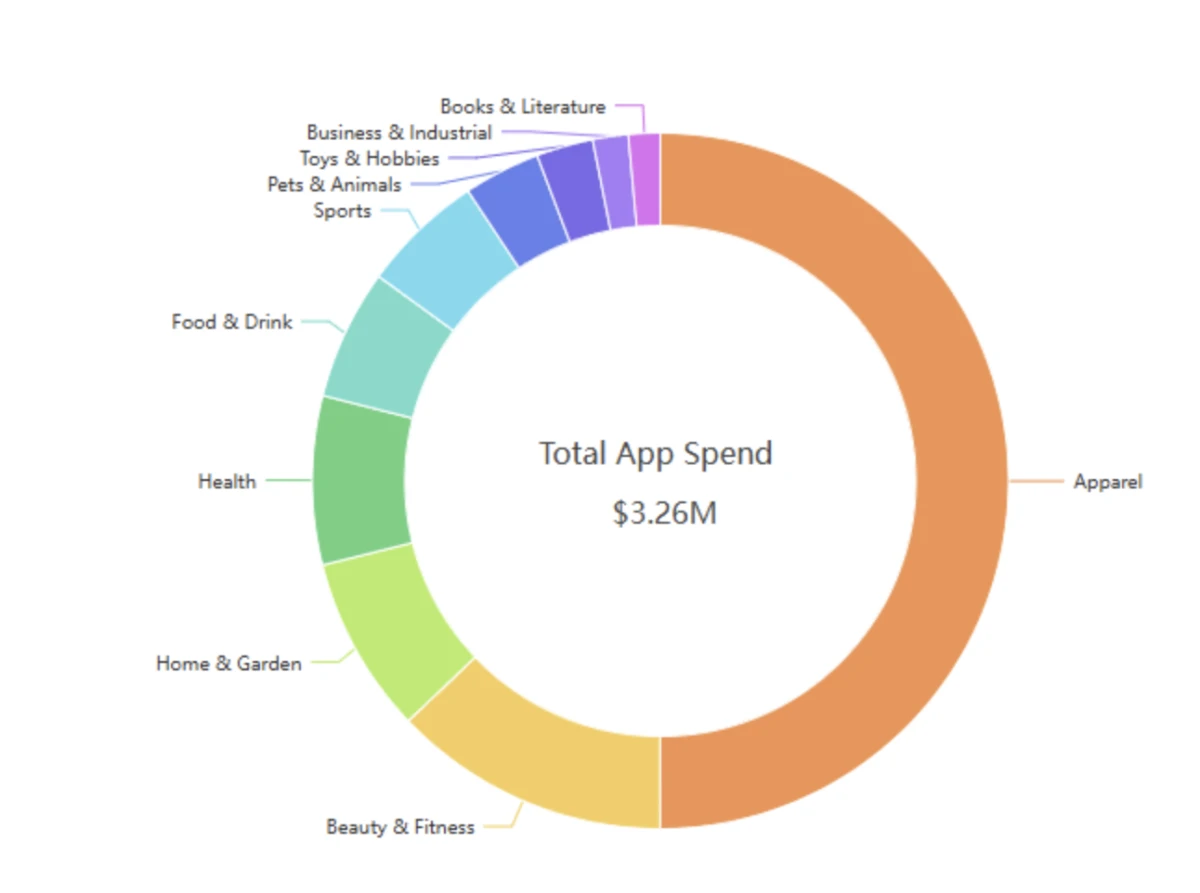

The distribution by shop segments also reveals clear patterns: fashion is currently the most common product group, closely followed by home & garden items. Together, these two segments account for 22.75 % of all shops and generated 28% of total e-commerce revenues.

This dynamic makes one thing clear: anyone serious about the Czech market needs to monitor trends regularly and react with flexibility.

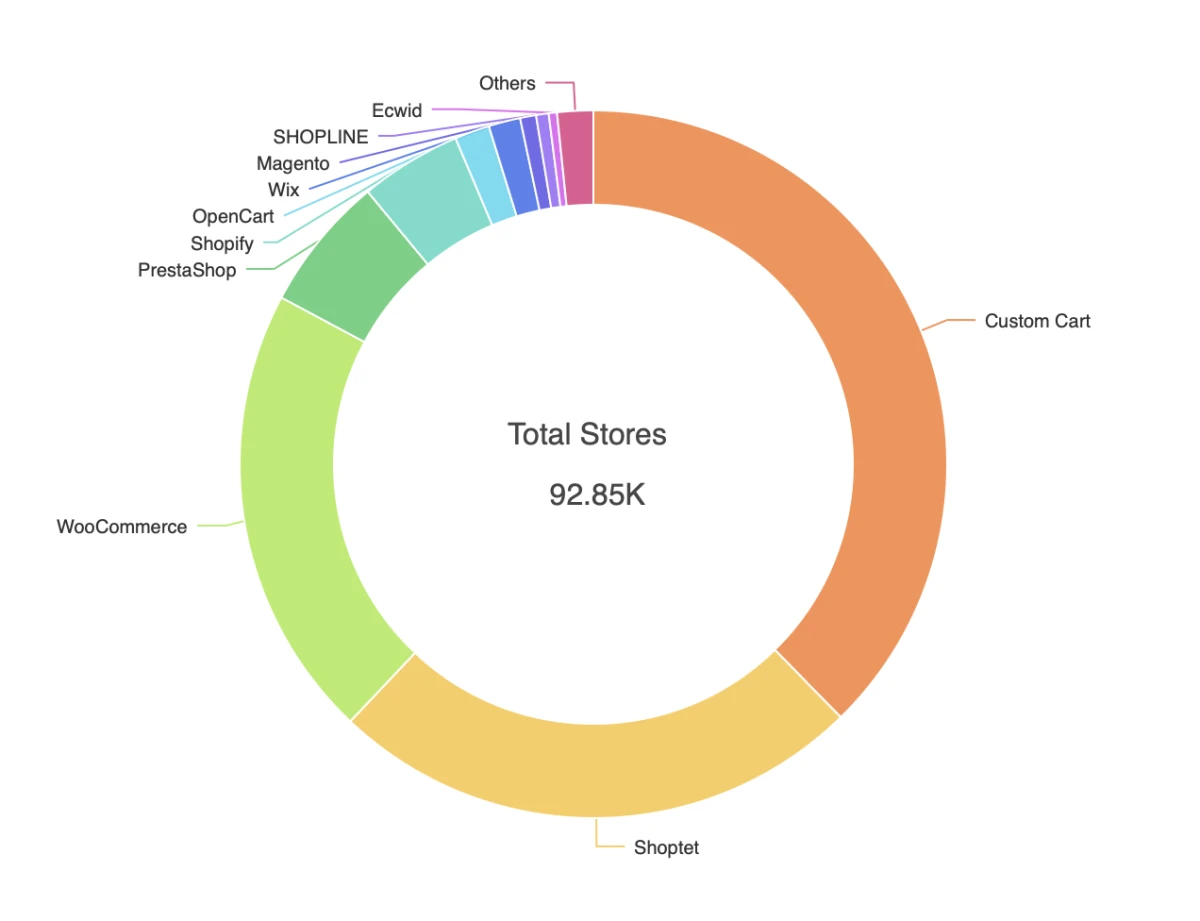

Another crucial factor is the platforms powering online shops. In Czechia, the most widely used solution is “Custom Cart” (≈37 %), followed by Shoptet (≈24 %). For new market entrants, this is an important signal of which systems have proven successful – and which ecosystem to consider when entering the market.

Czechs rank among the most active online shoppers in Europe. In 2024, 82 % said they browse online shops at least once a week, and 46 % actually make purchases that frequently.

Cross-border shopping is also popular: 34 % of consumers regularly order goods from abroad – often from Germany, attracted by lower prices, a wider product range, or items not available locally. At the same time, 45 % would order even more from foreign shops if free and hassle-free returns were offered.

When it comes to delivery preferences, the picture is diverse: about one-third prefer home delivery, another third opt for parcel lockers, and the final third choose parcel shops. Flexibility is crucial: 68 % would change their delivery address after placing an order – for example, switching to a parcel shop if they realize they won’t be home at the expected delivery time.

There are also clear device usage trends. Around half of online shoppers use a laptop or desktop PC, while about one-third shop exclusively via smartphone. For retailers, this underlines an essential rule: an online shop must work seamlessly across both desktop and mobile devices to keep customers engaged.

"In the end, there is no single “magic formula.” What works is always industry- and company-specific. There is no one-size-fits-all measure that guarantees success. What matters is conducting a thorough analysis and then staying flexible enough to improvise.This is especially true in Central and Eastern Europe, including Czechia, where improvisation is often key. At the beginning, German strategies and processes only go so far. Companies should remain open to different tactics and approaches – rather than clinging to old methods."

Step-by-Step to Digital Expansion

Understanding the Market and the Competition

The first step is a thorough market analysis. With a projected market volume of USD 8.03 billion in 2025, Czechia is considered one of the fastest-growing e-commerce markets in the EU, with an expected CAGR of around 5 % through 2030.

The strongest segments include fashion, home & garden, and electronics. In fact, fashion and household goods alone account for 22.75 % of all Czech online shops, generating 28 % of total revenues.

International companies can benefit from the strong brand image of foreign products: items associated with quality and reliability enjoy high trust among Czech consumers. At the same time, however, local competitors such as Alza.cz, Mall.cz, and Rohlik.cz are serious challengers. Businesses aiming to expand should therefore evaluate early on how their offering is positioned against local players.

Localization – More Than Just Translation

A simple language version is not enough. The most successful shops are those that address cultural nuances. This includes:

Language adaptation: Czech is a must – machine translations look unprofessional.

Currency & pricing: Shoppers expect prices in CZK, including transparent shipping costs.

Trust signals: Certifications such as “Heureka Verified Shop” or trust seals from APEK significantly increase purchase willingness.

Payment methods: While cash on delivery still dominates, “Buy now, pay later” models and mobile payments like Apple Pay are rapidly gaining traction.

“If you take the local conditions into account – such as the strong importance of cash on delivery – and conduct a solid market analysis beforehand, international companies can successfully gain a foothold in Czechia even without a local subsidiary.”

👉 This is where we can support you directly – from professional translation to adapting to legal and technical standards. Book a meeting with us and get non-binding advice.

Legal & Tax at a Glance

Czechia is part of the EU Single Market, which makes expansion easier for international companies. Still, there are a few important specifics to keep in mind:

VAT (Value Added Tax)

For cross-border sales, the EU OSS (One-Stop Shop) scheme applies.

The standard VAT rate is 21 %.

EU-wide, the annual threshold is €10,000. If you exceed this, registration is mandatory – alternatively, you can use the OSS portal.

Since January 1, 2025, Czechia has introduced new thresholds for VAT registration: businesses must register if their turnover exceeds CZK 2,000,000 in the previous year or CZK 2,536,500 within a 12-month period. The former small business exemption no longer applies – a critical note especially for B2C sellers.

For companies without a local subsidiary, the OSS or the Import OSS (IOSS) can be used to easily declare and tax third-country deliveries (goods under €150).

Consumer Protection

Czechia fully implements EU directives such as the E-Commerce Directive (2000/31/EC) and the Consumer Rights Directive (2011/83/EU). Online shop operators must ensure:

Clear Terms & Conditions, cancellation policy, prices incl. taxes & shipping costs, cookie usage, and contact details.

A 14-day right of withdrawal without giving reasons.

Security standards such as TLS/SSL and GDPR-compliant privacy policies.

Using Online Marketing Smartly

Digital marketing works a little differently in Czechia compared to Germany:

Search engines. While Google clearly dominates with a market share of over 80%, Seznam.cz still accounts for around 12–13 % of all search queries. This means that both search engines should be considered for SEO and SEA strategies – Google for reach, and Seznam for local visibility.

Comparison portals. Heureka.cz is almost indispensable for visibility – consumers use it as their first point of orientation before making a purchase.

Social media. Facebook and Instagram remain the most popular channels, while TikTok is growing rapidly. Still, Czechs are among the least likely in Europe to buy directly via social media – only about one-third have ever made a purchase through these platforms.

Influencer marketing. Especially in fashion and cosmetics, many companies rely on local micro-influencers to build reach and trust.

“Czech customers tend to be more impulsive – they don’t need many clicks to complete a purchase. Facebook and Meta still play a much bigger role here than in Germany. On the other hand, it’s a waste of money to invest where the target audience isn’t active.People also use Seznam.cz as a search engine – and if you’re not listed there, you’ll hardly be seen. Heureka.cz is practically a must for visibility and trust. When it comes to payment methods, cash on delivery still dominates. Buy now, pay later is far less common than in Germany. And overall, Czech consumers are more price-sensitive and expect regular discount campaigns.”

👉 Here too, we can support you directly – from market strategies and analysis to influencer marketing and social media.

Organizing Logistics & Fulfillment

Fast and affordable delivery is a decisive factor for Czech customers. In 2024, the average order value was CZK 1,333 (≈ €54), showing that shoppers are increasingly buying everyday products – and expect corresponding delivery standards. 48% of customers abandon their cart if delivery is too expensive.

Local logistics partners play a central role:

Zásilkovna operates a network of thousands of pick-up points and is among the most popular delivery options.

For international shops, shipping from abroad is possible, but costs and delivery times must be communicated clearly and transparently.

Those looking to unlock the full long-term market potential should consider a local fulfillment center to optimize returns and shorten delivery times.

Quick Checklist

Start with market analysis

– Review market volume & trends

– Analyze competitors like Alza.cz, Mall.czLocalize your shop

– Translate content professionally into Czech

– Show prices in CZK & transparent shipping costsBuild trust

– Use Heureka.cz & APEK seals

– Offer local payment methods (Cash on Delivery, BNPL, Apple Pay)Mind legal & tax requirements

– Apply the EU OSS scheme

– VAT rate: 21 %

– Respect return & withdrawal rightsUse online marketing smartly

– Optimize SEO for Google.cz & Seznam.cz

– Boost visibility via Heureka.cz

– Leverage Facebook, Instagram, TikTokOptimize logistics

– Partner with Zásilkovna (pick-up network)

– Communicate delivery times & costs transparently

– Consider local fulfillment for long-term successTrack trends & stay flexible

– Focus on growth segments like fashion, home & garden, sustainability

– Adjust your assortment regularly

Key Success Factors

Localization > Simple Translation

In Czech e-commerce, localization is not just a language adjustment – it’s a strategic advantage. Translations must be culturally accurate, prices and formats (e.g. CZK, measurement units) must be correct. Trust can be further built through local seals such as “Heureka Verified Shop” or APEK membership – both significantly increase conversion rates and purchase confidence.

Transparent Delivery Terms & Fair Pricing

Czech customers are highly price-sensitive and compare extensively. Transparency in shipping conditions and costs is essential: hidden fees or unclear delivery times quickly lead to cart abandonment. Fair prices – combined with fast delivery options such as Zásilkovna – are central to building trust and closing sales.

Customer Service in Czech (at least English)

Excellent customer support is a decisive factor. Ideally, it should be offered in Czech, otherwise at least in English. Shoppers expect clear communication, quick responses, and service that meets local expectations.

Social Proof: Reviews & Seals Are Crucial

Ratings, reviews, and trust seals carry enormous weight in Czechia – even more than in many other European markets. Consumers rely heavily on peer experiences, especially on Heureka.cz, where reviews are part of the purchasing journey. The keyword: Social Proof – a must-have for your market entry strategy. One study found that 61% of respondents would not place an order if a website lacked trust seals.

“Made in Germany” – A Quality Label

The so-called country-of-origin effect shows that “Made in Germany” positively influences purchase decisions – especially in Central and Eastern Europe, where German products stand for quality, precision, and durability. For international sellers, this is a powerful differentiator – and a strong sales argument with high impact.

“Localization is essential – but you don’t need to pretend to be fully ‘Czech’. On the contrary, the ‘Made in Germany’ label is a strong quality promise. I recommend communicating this aspect deliberately – for example on product pages or in banner campaigns, both online and offline.”

Case Study: About You’s Road to Success

How a successful digital expansion into Czechia can look in practice is shown by the example of German fashion e-retailer About You. This case study highlights the success factors that made the difference in the Czech market – from consistent localization to a powerful market entry strategy.

On October 9, 2018, About You launched its local webshop aboutyou.cz, making the leap from a well-established player in Germany to a serious competitor in Czech e-commerce.

From day one, the company relied on comprehensive localization:

The website was fully available in Czech,

Prices were displayed in CZK,

The assortment included more than 70,000 products from 500+ international brands at launch.

Localization went far beyond translation. Size charts, shipping options, and return processes were tailored to local expectations, ensuring a seamless shopping experience. By that time, About You was already active in six other countries, including Germany, Belgium, the Netherlands, Austria, Switzerland, and Poland.

The market entry was backed by a large-scale marketing campaign. It kicked off in Prague with an event for around 300 influencers and media representatives, and was reinforced with social media, out-of-home advertising, TV, and radio campaigns. The strong launch quickly paid off: within the first year, more than one million orders were placed in Czechia, according to industry magazine CzechCrunch.

Key to success was the clear focus on local needs. Czech customers expect transparent pricing, flexible payment methods, and fast delivery. About You implemented popular local payment options right from the start and optimized logistics for short delivery times and hassle-free returns.

What proved particularly effective was an optimized customer service and shopping policy:

30-day free returns,

popular local payment methods,

transparent pricing including shipping costs.

These factors are crucial in Czechia to build consumer trust.

For companies considering digital expansion into Czechia, About You offers several key insights:

A fast, attention-grabbing market entry can be decisive – when paired with careful localization of language, currency, and services.

The fashion segment is the largest in Czech e-commerce, making it a particularly promising entry point.

A clear marketing strategy with strong influencer and social media focus can significantly accelerate brand building in a new market.

“The biggest risk is entering without a market analysis. Companies need to know exactly why they are expanding, what the demand looks like, and how their own performance fits the market. Without real demand, there is no way to gain a sustainable foothold.”

This case study makes one thing clear: digital expansion requires more than simply translating a website – it thrives on a holistic adaptation to the market. About You has shown how, through consistent localization and a powerful first appearance, it is possible to establish a strong market position in Czechia within a very short time.

Conclusion: How to Succeed in Czech E-Commerce

Czechia offers international companies excellent opportunities for digital expansion – whether through their own online shop or via marketplaces such as Alza.cz. The market is dynamic, digitally savvy, and steadily growing, while at the same time consumers expect fair prices, fast delivery, and high service quality.

As the success factors show, a simple translation is not enough: localization means adapting language, currency, payment methods, and customer service consistently to Czech needs – while still leveraging the strong “Made in Germany” quality label as a trust-building element. Social proof through reviews and trust seals is indispensable for winning consumer confidence in this highly competitive market.

The About You case study demonstrates that a well-prepared, clearly executed market entry can lead to rapid success. Strong launch marketing, careful adaptation of the product range, and a customer-focused service conceptturned the German fashion retailer into a serious player in Czech e-commerce within just one year.

Our expert insights confirm this: anyone expanding into Czechia should start with thorough market analysis, prepare for price-conscious and service-oriented customers, and remain flexible in their approach. Expansion doesn’t have to be perfect from day one – what matters most is a fast entry, followed by ongoing adaptation to local conditions.

In short: With solid market analysis, a clear localization strategy, and an open, adaptable mindset, companies can quickly gain a foothold in Czech e-commerce. Czechia is not just a neighboring country – it is a nearby growth engine for international online shops.

“Expansion doesn’t need to be perfect from the start. Especially when entering Eastern Europe, it pays to approach the market with a degree of improvisation. Processes and strategies can be built up step by step – what truly matters is staying open, adaptable, and aligned with the local business culture, ready to adjust as conditions change.”

Have we sparked your interest? We’d be happy to support you with your expansion – or simply advise you on potential opportunities and strategies.

👉 You can book a free, non-binding consultation anytime at going.international/contact.

Let’s start the conversation!

How we can help you

Our team will help you with the first steps of your expansion as well as long-term marketing strategies.